GST Registration In Delhi | Procedure | Documents Required

GST registration is mandatory for all entities involved in the buying or selling or providing of services in India. Our experienced Chartered Accountants are offering GST Registration In Delhi, Bangalore, Pune, and in all other states of India.

GST (Goods and Service Tax) is a tax levied when a consumer buys goods or services. The main aim of introducing GST is to bring all the taxes into a single umbrella. This bill helps to eliminate the cascading effect of taxes on production, distribution prices on goods & services. Goods & service tax refers to the indirect tax which replaces taxes levied by the central & state government. Do refer GST rules and guidelines that you should follow to stay compliant

CA in Delhi is the leading business services platform in India, where you can find various Chartered Accountants to avail services like income tax filing, GST return filing, private limited company registration, trademark filing, and more. CA In Delhi can also help you obtain GST registration in Delhi, Bangalore, Pune, and in all other states of India at a mere Rs. 1,999/- and maintain GST compliance The average time taken to obtain GST Certificate is about 5 – 10 working days, subject to government processing time and client document submission.

Procedure For GST Registration:

Whether you do GST Registration in Delhi, Pune, Bangalore, or any state of India, the procedure remains the same. Below mentioned is the three-step procedure by which your business gets registered.

- GST Documents Preparation Preparation: A Chartered Accountant will help you prepare documents necessary for GST Registration. You can choose a Chartered Accountant from the list of highly qualified Chartered Accountants on CA in Delhi’s homepage.

- GST Application Filing: Once the documents are ready, your Chartered Accountant will file your application online and provide you ARN number immediately.

- GST Registration Certificate: Once the GST application and the attached supporting documents are verified by the Officer, GSTIN and GST Certificate is provided.

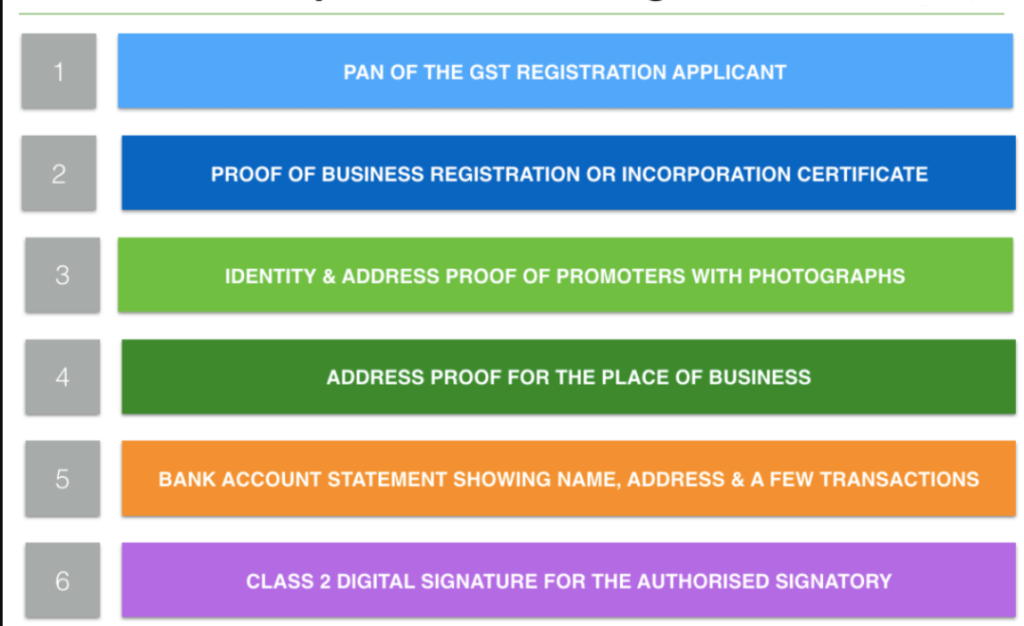

Documents Required For GST Registration:

1) PAN Card of the Business or Applicant

GSTIN is linked to the PAN of the business. Hence, PAN is required to obtain a GST certificate.

2) Identity and Address Proof of Promoters

Identity proof and address proof documents like PAN, passport, driving license, aadhaar card, or voter identity card must be submitted for all the promoters.

3) Business Registration Document

Proof of business registration like incorporation certificate or partnership deed or registration certificate must be submitted for all types of registered entities.

4) Address Proof for Place of Business

Documents like rental agreement or sale deed along with copies of electricity bill or latest property tax receipt or municipal khata copy must be submitted for the address mentioned in the GST application.

5) Bank Account Proof

A scanned copy of the first page of bank passbook showing a few transactions and the address of the business must be submitted for the bank account mentioned in the registration application.

6) Digital Signature

Class 2 or class 3 digital signature is required for the authorized signatory to sign and submit the GST application. In the case of a proprietorship, there is no requirement for a digital signature.

To get full details of the document based on your business type, visit Documents Required For GST Registration

Advantages

- Legally recognized as suppliers of goods or services

- Tax paid on the input goods or services which can be utilized for payment of GST, i.e., ITC allowed to registered persons.

- Legally authorized to collect tax from his purchasers

- Eligible to avail various other benefits and privileges rendered under the GST laws.

Penalties for not Completing GST Registration:

Offenders who do not pay tax or fail to make the full payment will face a penalty of 10% of the tax amount. The minimum amount of the fine will be Rs.10, 000 if the 10% amounts to anything less. In case of deliberate tax evasions, offenders will be charged a penalty of 100% of the tax amount. The penalty will be 10% of the tax due in case of genuine errors.

Persons not required to obtain GST

- An agriculturist, to the extent of supply of produce out of cultivation of land

- A person making supplies of goods or services that are not liable to tax under GST or wholly exempt under GST.

- Individual advocates (including senior advocates)

- Individual sponsorship service providers (including players)

Hire Chartered Accountant For GST Registration In Delhi, Bangalore, Pune, or any state in India: You can hire a Chartered Accountant from a list of highly qualified Chartered Accountants on CA In Delhi’s homepage