Partnership Firm Registration In Delhi

What is Partnership Firm

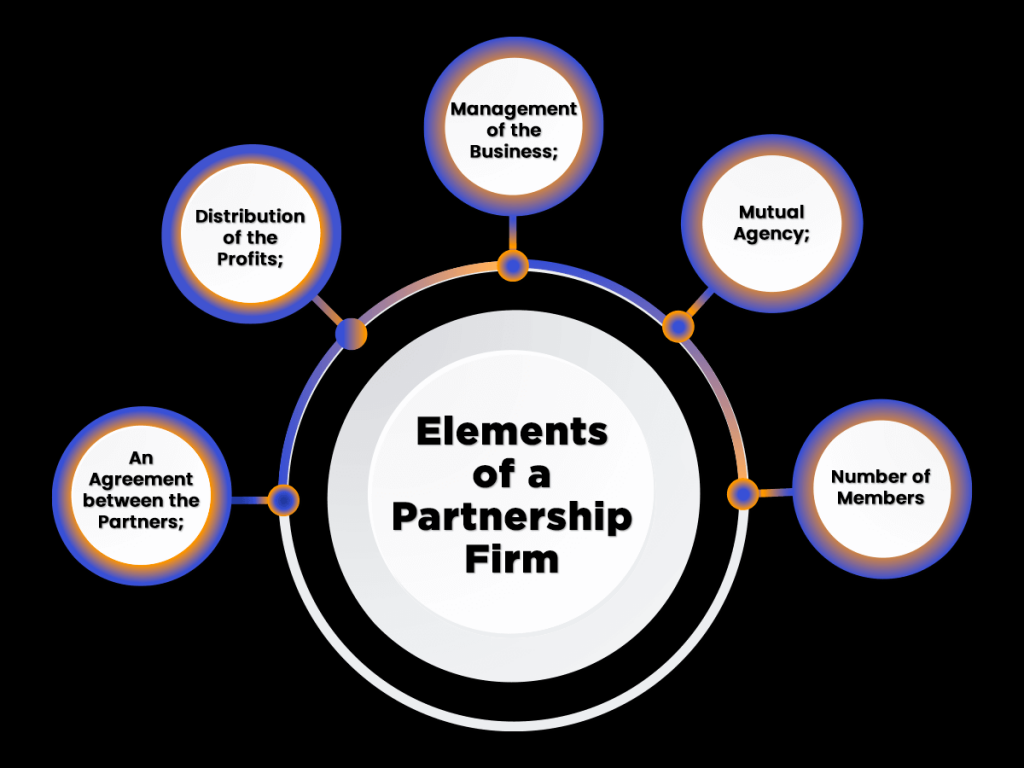

A partnership firm is a business structure in which two or more individuals manage and operate a business by the terms and objectives set out in a partnership deed that may or may not be registered.

A Partnership Firm Registration In Delhi enables a well-recognized business structure formed with the mutual consent of all the partners for a profitable purpose. The firm is managed, owned, and controlled by a set of people that are known as partners and have some shared capital in the firm. A partnership firm is done under the Partnership Act, 1932 with very little documentation and formalities.

Partnership firms are distinguished as registered and non-registered firms. It is not mandatory to register but it is advisable to do so. The firm offers various benefits that do not apply to non-registered ones.

Basic Clarification

An association of two or more people who have decided to indulge in business activities is regarded as a partnership firm. The motive of such an organization is to earn profit. Members of such a partnership firm are called partners. All the partners share the profits and losses in the proportion of their respective owners.

In a partnership firm, the amount of money contributed is often huge because each partner can contribute to the total amount of capital required. The decision-making process in a partnership firm is a collective business. Every partner should be on the same path before taking any decision. Without firm registration, two partners cannot start their business venture.

Things to Consider While Naming the Partnership firm

As long as you satisfy the below-mentioned terms & conditions, any name can be given to a partnership firm. The conditions are given below:-

- The name shouldn’t be too identical or similar to an existing firm operating the same business actions,

- The name shouldn’t contain words like a crown, empress, emperor, empire, or any other words which show approval or sanction of the government.

Benefits of Partnership Firm Registration in Delhi

- Easiest Business Structure : Partnership firms are one of the easiest business structures that can be started by formulating a partnership deed for which is necessary. Hence it can be started when the partners are ready and with minimum documentation, whereas other firms require at least 10-15 days covering up all the formalities like obtaining DSC, DPIN name approval, etc.

- Ease In Decision Making : It’s easier and faster to decide on a firm registration as you don’t have to follow regulations to pass a resolution. A partner can perform transactions on behalf of the firm without any consent of other designated partners.

- Raising funds : Incompetence to other firms such as proprietorship firms, funds can be easily raised in a partnership firm. Multiple partners are capable of making a more feasible contribution. It must be noted that banks consider a partnership firm more favorable for sanctioning credits and loans.

- Easy Management Without Any Disputes : All the partners are assigned works and responsibilities as per their capability, as mentioned in the partnership deed. Partnership deed helps in avoiding any type of conflicts between the partners.

- Ability To File Case Against Third Parties : The designated partners of the registered Partnership Firm can file a case against Third Parties to resolve disputes that have been aroused during business operation or any other case relating to the Partnership Firm in India. You must also note that any unregistered Partnership firm loses the right to file the case against a third party to resolve any disputes till the procedure of Partnership Deed Registration has been completed.

- Can File Suit Against Co-Partners : It is evident in the contemporary world that the Court of Law best resolves the resolution of any dispute as no one knows when the dispute between the Partners may arise in terms of the sharing of profits or any other case relating to the operations of the Partnership Firm. In continuation to the above said, the Partners of an unregistered Partnership Firm cannot enforce any clauses of registered Partnership Deed.

- Ability To Claim Set-Off : After availing of the Firm Registration, the partners enjoy the right power to claim set-off. If there is any claim against a third Party, Partnership Firm can claim the set-off when any third party files a suit against the registered Partnership Firm. This particular power of claim set-off is not available when the Partnership Firm is unregistered under the Act, Indian Partnership Act, 1932.

- Enjoys Higher Credibility : A Partnership Firm that has completed the procedure of Online Registration of Partnership Firm enjoys higher credibility in comparison to an unregistered Partnership Firm. Even though, both registered and unregistered Partnership Firms are legally valid under the given Act Indian Partnership Act, 1932, the Registered Firm is highly referred in continuation by authorities over unregistered ones.

- Easy Conversion Of Entity : The conversion of the registered Partnership Firm into any other establishment such as a Private Company or Limited Liability Partnership, which are broadly known as the corporate structure, can be easily accomplished.

Documents Required for Partnership Firm Registration In Delhi

Partners need to submit the documents when they are registering the partnership firm, such as partnership deed, PAN Card of Firm, Address Proof of Partners, Office Address Proof, GST Registration, Current Bank Account along with an affidavit certifying all the details mentioned in documents and deed correctly.

- Partnership Deed: A partnership deed is a kind of agreement formed within the partners which defines their rules, duties, methodology, functions, and shares. It helps to avoid future conflicts and disputes between the partners. It is created and signed by all the members on the Judicial Stamp Paper that costs around Rs. 2000/-

- PAN Card Of Partners: All the designated partners of the firm are required to submit their PAN cards as proof of their identity.

- PAN Card Of Firm: Designated Partners of the Firm need to apply for PAN card of the firm. They have to file Form 49A to apply for a PAN of the firm. They should visit – https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html In case of the authorized partner signs the application using a DSC, it can be filed in the online mode also. Besides, the application along with the requisite documents must be sent to the nearest PAN processing centers accessible across the country.

- Address Proof Of Partners: All the partners have to submit a copy of their address proof which can either be their aadhar card, voter id, ration card, driving license, etc. The address and details given in the document should match PAN card details.

- Office Address Proof: Address proof of the respective working place has to be submitted. In the case of rented property, an applicant has to submit a rent agreement along with a utility bill such as electricity, water, gas bill, property tax bill, etc. Apart from it he/she has to submit the No Objection Certificate (NOC) from the landlord. If the place is owned by any partner or partners then the applicant has to submit a utility bill along with a NOC.

- GST Registration : firm needs to submit a PAN card number, address proof of the firm, and identity & address proofs of the partner to obtain GST registration. The authorized signatory will sign the application either using DSC or E-Aadhar verification.

- Current Bank Account : The firm needs to submit the following documents for opening a current bank account, which is as follows:-

Register a Partnership Firm in Delhi

FAQ- Frequently Asked Question

What is a partnership firm?

A partnership firm is a business structure in which two or more individuals manage and operate a business by the terms and objectives set out in a partnership deed that may or may not be registered.

Is a partnership firm a separate entity?

The partners in a partnership firm are the owners and thus are not separate entities from the firm. Any legal issues or debt incurred by the firm is the responsibility of its owners, the partners.

How many partners can there be?

A partnership must have at least two partners. A partnership firm in the banking business can have up to 10 partners, while those engaged in any other business can have 20 partners. These partners can divide profits and losses equally or unequally.

How much time does it take to register a partnership firm?

The registration of a partnership firm in India can take up to 10 to 12 working days. However, the time taken to issue a certificate of incorporation may vary as per the regulations of the concerned state. The registration of a partnership firm is subject to government processing time which varies for each state.

What are the minimum and the maximum number of partners required for the formation of partnership firms in India?

A minimum of 2 persons and a maximum of 20 is required for the formation of a partnership firm.

Who can be the partners in a partnership firm?

The individuals who are residing in India can only become partners or members of a partnership firm. Foreign individuals who want to form their business in India can choose private limited companies.

What is the capital amount needed for the partnership firm registration in India?

There is no minimum capital requirement for the registration of a partnership firm in India.

Are there any grounds on which my partnership can be invalid?

Often, if the partnership agreement is not registered, the court may deem a partnership invalid. If the object of the business is illegal, the court may consider the partnership invalid and dissolve the partnership.

What is the scope of liability when it comes to partnerships?

Every partner is jointly and severally accountable for any acts/activities of the firm committed throughout the course of business while he or she is a partner. This means that if a third party is injured or a penalty is imposed during the course of business, all partners will be held accountable, even if one of the partners caused the injury or loss.

If you want to get started with Partnership Firm Registration in Delhi, reach out to Chartered Accountants from CA in Delhi‘s homepage