GST Refund Services | Application | Process | Export

Overview of GST Refund

GST Refund- Goods and services tax is about smooth cash flow and regulatory compliance, making it easier to do business in India. To ensure this stable flow, the government must establish a barrier-free refund system. The current tax structure is very cumbersome, and national tax refunds can take months or even years.

GST provides an efficient and dynamic invoice tracking system to check and systematically monitor every transaction, which is of great help to manufacturers and exporters, especially in 100% export-oriented units or special economic zones. Due to the slow repayment process, its working capital was frozen.

The GST refund service

We have a number of associated GST refund consultant in Delhi and can help you solve the following problems:

- Submit a reimbursement application,

- Prepare a complete document of the reimbursement process,

- Prepare a confidentiality statement for disclosing tax data to others,

- All necessary certificates to the department,

- Representative auditor on behalf of the client,

- Follow up regularly in the department to receive reimbursement as soon as possible,

- Any suggestions on reimbursement,

In some cases, refunds will be issued. Let’s take a closer look.

Refund of tax credits

- Export goods or services to LUT/Bonds without paying GST

- Delivery of goods or services to FWZ units and developers to LUT/Bond without paying GST

- Refund of accrued temporary tax credits arising from the inversion of the tax structure, If the provisional tax rate is higher than the provisional tax rate.

IGST reimbursement for zero nominal delivery

4. Use GSTS to pay for exported goods or services

5. Use GST to pay for goods or services to SEZ units and developers

Refunds are part of a well-thought-out export plan.

6. Export review (refundable for both the supplier and the recipient),

Refund to UIN holder

7. Refund of taxes paid for purchases from UN agencies, embassies, etc.

8. Return to the Correctional Services Department Canteen

Tax refund for international tourists

9. The tax refund paid by international tourists for goods purchased in India and exported abroad when they leave India.

Other reimbursements

10. Reimbursement based on a decision, order, order, or instruction of the Appellate Body, Court of Appeal, or any other court.

11. Refund after completion of preliminary inspection

12. Excess portion in the electronic cash book

13. Overpaid tax due to error or error

14. If the delivery is regarded as an interstate delivery and later proves to be a domestic delivery, pay IGST compensation on the contrary

15. When the goods or services are actually delivered, a refund of the receipt of the prepaid tax is issued

The above list is for reference only and is not exhaustive.

GST will not issue refunds until the taxpayer makes a request. They have a systematic approach. Taxpayers must apply and obtain it following the correct procedures. Refund to your bank account.

When is the deadline for submitting a refund request?

Taxpayers must submit their application within two years from the relevant date specified in the description of Article 54 of the 2017 CGST Law. The meaning of “relevant dates” should be understood to mean that these dates are different under different circumstances,

As described below:

| S.No | Situations | Relevant Date |

| (a) | If possible, for goods exported outside of India, refunds of taxes paid on the goods themselves or (if applicable) the inputs or services used in these goods can be refunded, | |

| (i) | If the goods are exported by sea or air | The date on which vessel or aircraft in which goods are loaded, leaves India |

| (ii) | If goods are exported through a land route | The date on which such goods pass the frontier |

| (iii) | If goods are exported by post | Date of dispatch of goods by the post office concerned |

| (b) | In the case of a supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods | The date on which return related to such deemed exports is filed |

| (c) | For services exported outside India, if the tax paid on the service itself or (if applicable) the intermediate or intermediate consumption used in these services can be refunded, | |

| (i) | Where the supply of services had been completed before the receipt of payment against such supply | Date of payment in convertible foreign exchange or in INR wherever permitted by RBI |

| (ii) | Where payment for the services had been received in advance before the date of issue of invoice | Date of issue of invoice |

| (d) | If the tax can be recovered due to a decision, order, order, or order of the Appellate Body, Court of Appeal, or other Court | Date of communication of order |

| (e) | In case of a refund of unutilized ITC arising due to ‘inverted tax structure’ | According to Article 39, the reimbursement period expires during the period in which the reimbursement occurs. |

| (f) | In the case where tax is paid provisionally under this Act or the rules made thereunder | The date of adjustment of tax after the final assessment thereof |

| (g) | In the case of a person, other than the supplier | The date of receipt of goods or services by such person |

| (h) | In any other case | The date of payment of tax |

These respective data consider because any negligence in submitting a redemption request within the specified time frame may result in unnecessary freezing of funds.

What is the GST refund process?

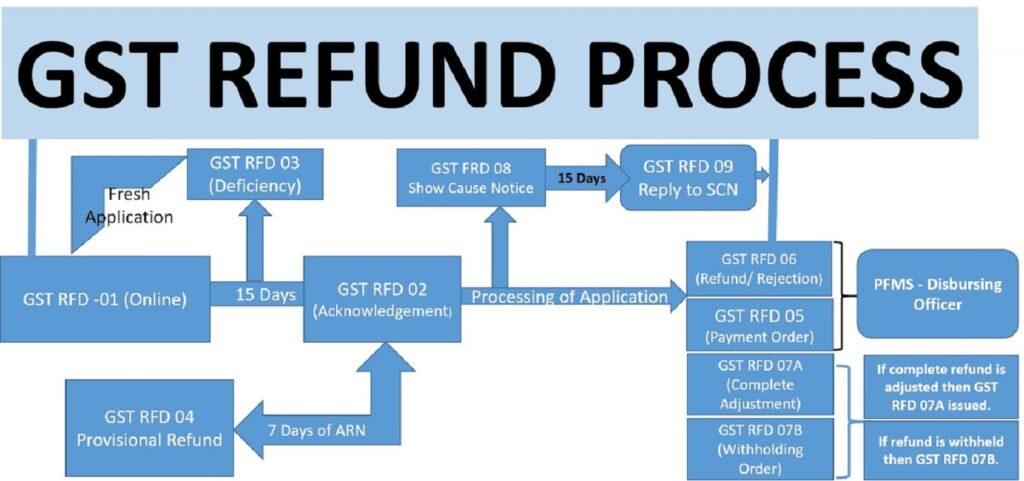

1. Any taxpayer must use form GST RFD-01 to apply for a refund. After submitting the form in the GST RFD-02 form, a confirmation of further use generates and sent to the applicant via email and SMS.

2. If the system detects an error in the refund request, reported it within 15 days. The responsible officer issues the GST RFD03 form (defect memorandum) to the applicant and points out the problem through the shared portal requested electronically. Submit a new reimbursement request after these deficiencies are remedied.

3. After reviewing the application and submit evidence, and determining that the required compensation amount should attribute to the applicant, the person in charge issues a preliminary compensation order from GST RFD04, in which the compensation for the designated applicant, temporarily canceled within 7 days from the date of receipt of the confirmation letter.

4. The authorized amount on the GST RFD05 form charge electronically to one of the bank accounts specified by the applicant in their registration details and refund request.

5. If you find the attachments in order, please fill in GST RFD06. Refunds must be approved in all aspects within 60 days of receipt of all claims. In the case of delayed approval, the interest rate is @6% p.(As currently communicated) must be paid under section 56 of the 2017 CGST Act.

Can I refuse a refund?

If the person in charge believes that the complaint is inappropriate or not paid to the complainant, he must provide the complainant with the GST RFD-08 form within 15 days after receiving the claim and request a response on the GST RFD-09 form. notify. After reviewing the applicant’s response, the office can accept or reject the return request and approve the order accordingly.

Is there a minimum return threshold?

If the refund amounts below 1,000 rupees, no refund to the applicant. This restriction applies to all tax authorities (not the total tax). When the excess credit returns in the cash account book, the limit do not apply.

| Applicant | Refund claimed | Admissibility |

| Mr. A | CGST: Rs 900 + SGST Rs 900 | Refund inadmissible – as limit shall be applied for each tax head separately and not cumulatively |

| Mr. B | IGST: Rs 1200 | Refund admissible fully |

What evidence needed to avoid disclosing tax information to others to apply for a refund?

In addition, the documents need to prove the approval of the tax

(i) When the amount of the refund request is less than 200,000. There are enough people to process reimbursement applications.

(ii) A certified public accountant must be provided for reimbursement requirements of 200,000 or more. However, no prior declaration/certification requires in the following cases:

(a) Refund of tax paid

Exports of goods and services, or inputs or services used to perform these exports

(b) Reimbursement of unused ITC under Article 54(3);

(c) For incomplete or partial supply and no invoices or receipts Rebates paid for the supply of return receipts;

(d) Refunds of taxes paid on transactions that treat them as domestic deliveries but later treated as interstate deliveries, or, conversely,

(e) Taxes or interest borne by the declared group of applicants.

The process itself is tedious, and if done correctly, the rewards can be very simple and straightforward. This will change the face of the long-term cost recovery process and promote the manufacturing or export industry. Refunds that use to take years can now complete in just 60 days. The powerful IT system GSTN actively supported this on-site event.