How to Register a freelancer’s business

Register a freelancer’s business and Know about Legal requirements

Are you looking to start a career as a freelancer? You are at the right place. This post will help you guide how you can register a freelancer’s business. We understand your dream is to follow your passion and be a master of your schedule. But at the same time, you must also need to consider the legal requirements for freelancers in India. You might be having a lot of questions, confusion about how to get started, legal requirements, business requirements. But don’t worry, this post will cover up all.

Freelance Registration and License in India

If you are starting up as a freelancer, you do not need to mandatorily register a business until your work reaches a certain turnover limit. You can continue to work as a freelancer, with your existing PAN number, if your annual freelancer income is not more than 20 lacs per year. TDS (Tax Deducted at Source) process on your PAN card and included in your income tax.

In other words, If your annual income is less than 20 lacs, you can be freely Freelancing in India, but for various business reasons, still a good option to get yourself register as a proprietor with a mere GST Registration. If you require any assistance with GST Registration, our team will be happy to help you out. You can choose from a list of Chartered Accountants from our homepage.

Once your business register under GST, you can open a current account on behalf of your business and issue a receipt If you want to accept payment of more than 10 Lack rupees.

Additionally, the benefit of getting GST Registration is that you can claim your input tax credit of GST for business-related expenses (like laptop expenses, furniture, appliances, etc.)

Freelancer’s tax In India (Goods and Services Taxes and Income Taxes)

Like any other individual, freelancers are also suppose to pay taxes according to government regulations.

GST for freelancers

If a freelancer earns more than 20 lakh per year (in all states except the northeast of India), GST registration may be required. You must pay a GST of 18% (in most cases) for any income from professional services (mainly done online). For states in northeastern India, the limit is 10 lakh per year. For most professional services, the tax rate is 18%, but there may be exceptions for service fees,

Freelance income tax

India’s income tax law stipulates that any income a person earns through the exercise of skills consider a professional income, and self-employment income is the sum of all income you receive from your customers, So is, therefore, taxable income beyond a slab.

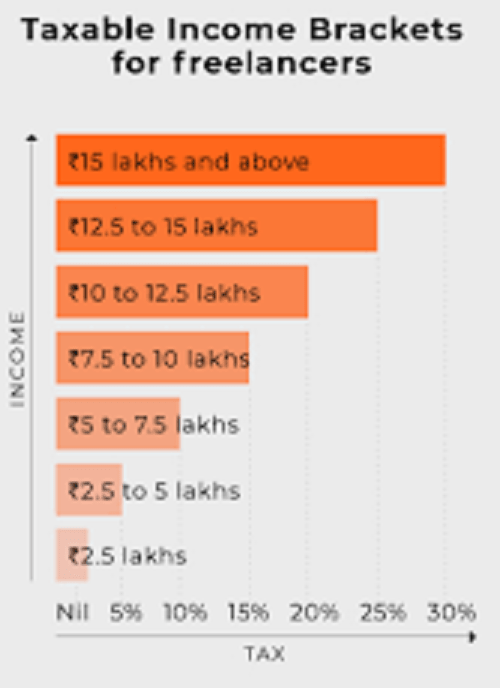

For Freelancer, income not exceeds 2.5 lakh will not tax. Income from 2.5 lakh to 5 lakh rupees is tax at a rate of 10%. 5 to 10 lakh to 20% and above 10 lakh to 30 percent. Freelancers can use Form ITR 4 when submitting tax returns.

You can use the Form 26 AS associated with your PAN number to help you find all detained TDS. As a self-employed person, you may also need to pay taxes in advance. Withholding tax is the frequent payment of taxes in a given year, rather than one tax payment in a given year.

According to Article 80 of the Income Tax Law, self-employed individuals can reduce tax expenditures by more than 1.5 lakh. That is when you invest a certain amount of money in tax-saving tools.

Freelance Contract:

One of the biggest challenges in a freelancer’s life is getting payments. Disputes arise when expectations do not match, so be clear and a complete contract must establish. The scope of work and payment terms mutually agree, negotiated, and formulated. Clearly state your presence in the contract.

As Register a freelancer’s business, you should consider some of the items in the contract.

- Remuneration: the agreed amount to be paid after the work completed.

- Deadline: The deadline set by both parties.

- Scope of work: Define the type of activities of the self-employed person during the contract period.

- Additional service: payment terms freelancers set default payment terms for each extra effort.

- Late payment terms: Freelancers can charge interest rates or set different deadlines (this is very important because some customers do not pay during this period).

- Advance payment: This clause allows freelancers to charge a certain fee in advance.

- Termination: The customer can choose to terminate the contract.

- Confidentiality: During the term of office, freelancers are not allow to transfer vacancies to third parties.

- Privacy: Shows the relationship between clients and freelancers.

The following are the main points to include in your Freelancer’s contract:

- Scope or purpose of work,

- Contract period, termination and start of the validity period, timetable

- Payment method

- Verification of basic information

Mainly, based on the effective considerations of Article 2 (d) of the Indian Contract Law of 1872,