Registration of Online homemade food business

Overview: Online homemade food business

Registration of Online homemade food business, If cooking food is your passion, now is the best time to turn your passion into a mature career. Turn your hobby into a profitable business by selling homemade food in the comfort of your home.

Online homemade food business, shopping at home?

In this article, we will reveal the secrets of successfully starting a grocery store at home, highlighting the different permits you need to obtain and other legal requirements you need to meet to get started.

Register with FSSAI?

When you sell homemade food online, you need to make sure that people trust your business. Obtaining an FSSAI license is the easiest way to gain credibility and trust. FSSAI registration proves to your customers that you comply with the highest quality and hygiene standards when preparing food at home. You can provide your FSSAI registration number on the online portal used to sell groceries to assure your customers that you will not jeopardize their safety.

Do I need to register with FSSAI to sell homemade food online?

According to the Food Safety Act 2006, all food operators in India must be registered with FSSAI. Therefore, if you want to sell homemade food online in India, you need to register with FSSAI. If you are a small-scale business, you only need to register with FSSAI. If you want to operate a large-scale business, you need a license.

FSSAI license or registration is also subject to company bills. The three options for people who wish to sell homemade food online are as follows:

- If the annual bill is less than 12 lakh, please use Form A to register.

- The government permit is billed annually on Form B: find 12 to 20 lakh.

- Obtained a central license through Form B, with annual sales exceeding 20 lakh.

If the restaurant operates in multiple states, the headquarters must also purchase additional central licenses. However, in most cases, the homemade grocery store is a small local business and only requires FSSAI registration. Documents required to obtain an FSSAI license.

Documents that may be required to obtain an FSSAI license:

- Form A/Form B duly filled out and signed.

- 2 Passport size photo.

- The PAN card of the alleged owner.

- Confirm the venue address.

- Certificate of Registration/Articles of Association or Articles of Association

- Grocery List Form

- Declaration form

- Authority letter

- Form IX: The Board resolution

How to open an online grocery store:

- Before starting such a business, you must first conduct a market analysis to understand exactly what to do and how to sell. And look for ways to position yourself as a tool to fill this gap by making it your unique selling proposition.

- you need to find local sellers and suppliers who can help you ship groceries at competitive prices. Develop brand-specific packaging and labeling systems to differentiate you from the competitors.

- Then register your grocery store with FSSAI.

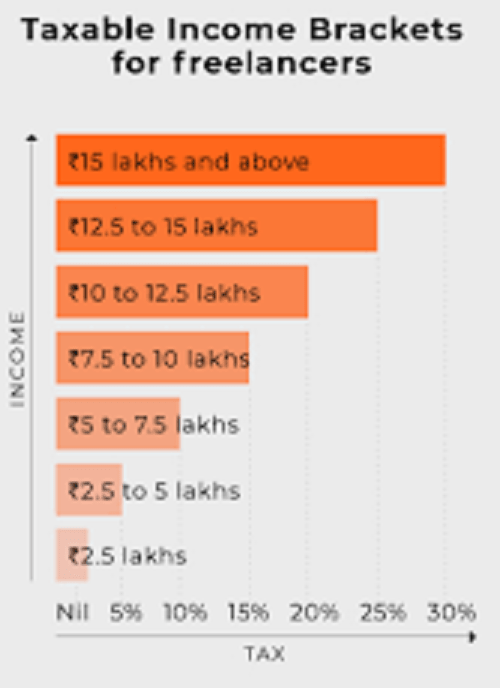

- If you want to expand your activities in the future, you will need to register for consumption tax, as this may exceed the tax exemption limit.

- Before proceeding, please consult your local health department and community for more information about legal requirements.

- Cooperate with other food e-commerce platforms, or you want to deliver it yourself. If you want to use the platform, please register on their portal and complete the verification process.

- Otherwise, you need to set up your website or application to accept orders. Create a website and publish your menu and product prices. To determine competitive food prices, compare your products with those of competitors by analyzing the market.

- If you want to choose online payment instead of the cash on delivery option, you may also need to work with payment platforms to ensure smooth transactions.

- First, establish a good reputation for customers and provide them with discounts and offers to spread your message about yourself.

- Remember to be creative in branding and marketing. Finally, you should continue to develop innovative marketing strategies to help you grow your brand and business organically.

Important considerations when opening an online grocery store at home:

- FSSAI licenses are valid for one to five years. According to FBO regulations, all family catering companies must apply for an extension at least 30 days before the license expires. If they fail to complete by the deadline, they will have to pay a fine of ₹100 for each day of extension. Therefore, all online food companies need to track the expiration date of their licenses.

- If the authorities discover that a food company is not registered with FSSAI or does not comply with its conditions, there is a risk of serious legal consequences. Unlicensed work can result in imprisonment or a fine of up to 5 lakh. Selling low-quality food can be fined up to 5 lakh.

- If you want to expand your grocery store in the future, registering may help. In this case, it is best to register as a sole proprietorship, LLP, or partnership.

- India’s food safety laws are slightly different. Therefore, it is best to contact a local prosecutor with experience in municipal regulations. This is necessary so that you can meet all requirements.

- In some cases, you may need another license to open a grocery store. The following are some of the licenses you may need:

- Shops and Establishments Act license

- Trade license

- NOC from fire brigade, police, municipality, and society

- Eating house licence and signage licence

- Environmental clearance