Overview of Post Company Incorporation Compliances:

Post Company Incorporation Compliances, In recent years, young people in India seem to have made more attempts to start a business. This incentive to build their legacy through a business empire is a boon for companies. A simpler and more effective process. However, entrepreneurs need to know the content of the business registration. But how exactly does the company registration process work in India? This article explains the process of the company and the compliances that follow registration.

Documents required to register a company in India:

For the registration of a Private limited company, at least two shareholders and the managing director and the following documents are required:

- Current passport photo,

- The Application form has been filled out correctly,

- Proof of identity: Aadhar card, passport, voter ID, grocery card, PAN card, or driving license,

- Bank statement of the last two months,

- Digital signature certificate of the future director,

- Director ID number,

- Work certificate: electricity, water, gas or telephone invoice/lease/owner NOC/Ownership Registration Certificate/India’s Property Tax Certificate

Business Registration in India: Process Overview

- First, the entrepreneur needs to choose a name that complies with the nomenclature for his company. You must use the SPICe + A form to submit your name to the Corporate Affairs Department for approval.

- After the MCA approves the proposed name, the business owner must correctly fill out and submit the SPICe + B form. You also need to upload a copy of the above-mentioned supporting documents.

- Then entrepreneurs need to meet with legal experts and start preparing their articles of association and company articles.

- Once all the documents required by the 2013 Companies Act are in place, the entrepreneur must go through the online registration process and have to pay the necessary processing fees online.

- The MCA officer will review all your records and process your registration application. If they are satisfied, they will issue a registration certificate within seven days.

After the entrepreneur gets the registration certificate, he can apply for a company PAN card, TAN, etc. In addition, entrepreneurs can also apply for registration with the National Workers Insurance and Insurance Fund. The MCA portal also allows entrepreneurs to simultaneously apply for GST registration for fast approval.

Post Company Incorporation Compliances in India:

You must follow multiple compliance measures to make it run smoothly. The following is a brief overview of the compliance that must be met immediately after registering a company in India.

- If the address is different from the office address at the time of registration, it is the internal address of the MCA headquarters.

- The first meeting of the company’s board of directors shall be held no later than 30 days after registration.

- Appoint an initial auditor and submit information about him to the MCA via Form 1 ADT.

- Open a bank account within 60 days of registration.

- Issue shares within 60 days of company registration.

- According to Article 10A, a registered startup can only be submitted after registration 180 Form Record INC20A MCA within days.

- Hold regular board meetings and prepare, manage and save your meeting minutes.

- The company may need to submit an MSME every six months.

- Companies registered under ESI, PF, and GST must submit monthly or quarterly reports as required. In addition, companies that own TAN must deduct and store the required amount of TDS each month. Once every quarter.

The following is a brief overview of the requirements that companies must meet each year

- If the company approves the customized solution, MGT14 send to the MCA.

- Use the DPT3 form to report company deposits and pre-payments.

- Use the DIR3 form to update and complete all information about KYC directors. Organization and extraordinary general meeting of shareholders.

- Create and update legal documents, including participant roster, shareholder roster, and company roster.

- Conduct a statutory audit if applicable with the Company Law, 2013(if applicable).

- If applicable, conduct a tax audit under the Income Tax Act of 1961.

- Conduct and report the results of goods and services tax audits by the 2017 Goods and Services Tax Act.

- Use forms AOC4 and MGT7 to prepare and submit annual financial statements to MCA as required.

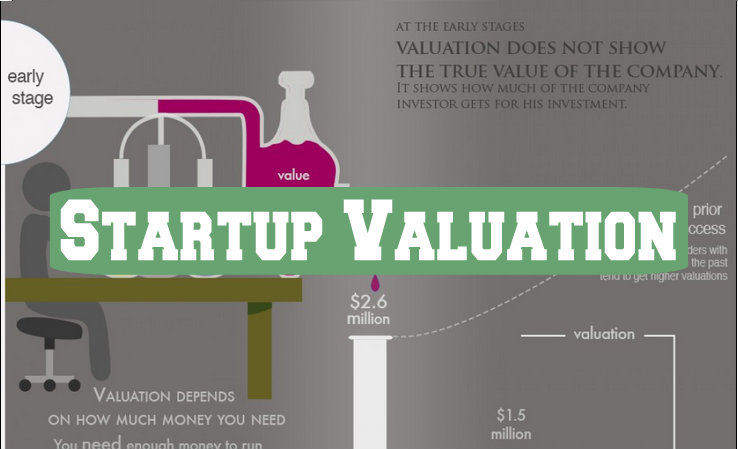

- After registration, start-up companies can apply for business expansion.

Optional post-registration registrations in India

The following is a brief overview of the various additional registrations that startups can apply for after registration to expand their business.

- Import and export registration for business expansion in overseas markets.

- If the company meets the requirements of the MSME Act, register with MSME. This will help companies take advantage of various government benefits, such as loans, grants, and social security programs. The Samadhan MSME program allows companies that file complaints to also charge customers.

- Trademark registration in case the company wants to protect its trademark, and a unique name or logo is a distinctive feature of the product.

- You can take advantage of these benefits by starting your registration in India, which provides various tax reliefs at regular intervals.

- If the company engage in the trade of food-related products or services, register with FSSAI.