How To Value A Startup : An Overview About Startup Valuation

Namastey from CA In Delhi! This article will guide you all about how to value a startup. The way startups are becoming the trend of the season, days are not far when pados wali aunties who used to compare marks of their children earlier as a part of gossip will ask each other “Mere bete ke startup ki valuation $3 million h. Tumhari beti ke startup ki kya valuation ho gyi?” [AdSense-B]

Every other day there is a news of a startup being valued and raising funds. Har cheez ki ek keemat hoti h and startup is inevitably one of them. But how are they valued? Let’s find out!

There are three stages of a startup:

– Early stage

– Growth stage

– Exit stage

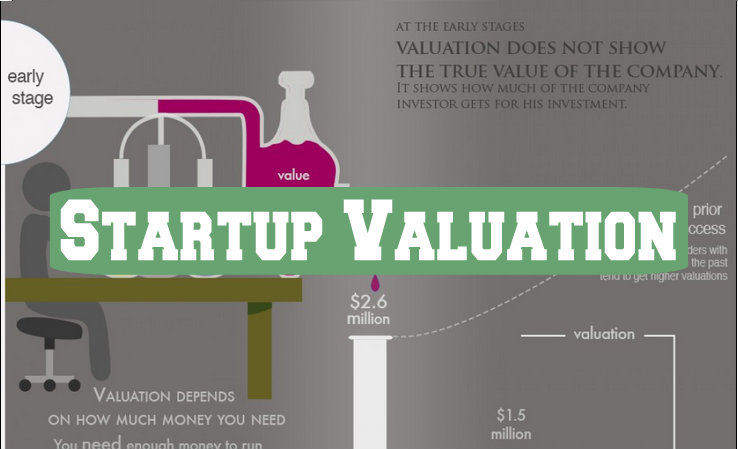

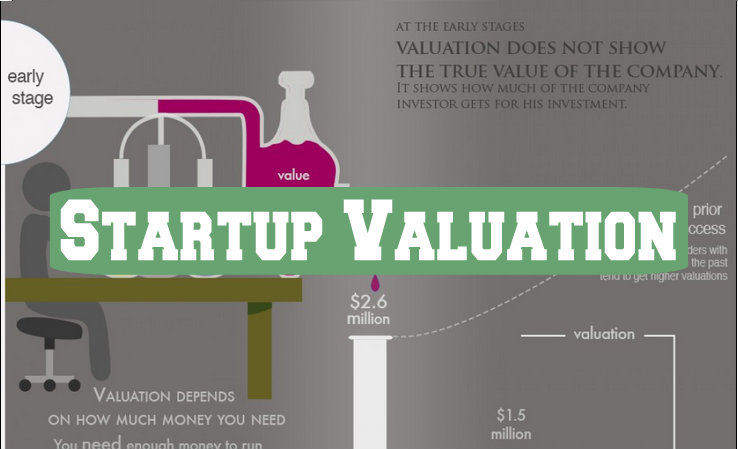

Early Stage

Early stage of a startup is a stage where the company has not generated any revenue or has generated very little. It has an idea or a plan (theoretical or implemented) that has a ‘potential’ to generate revenues in future.

To raise funds from investors in exchange of the shares in the company, you need to value a startup. Fund raising and share dilution normally depends on the kind of investor you are raising funds from (Angel investor, Micro Venture Capitalist, Venture Capitalist, friends and relatives, etc). Normally, 15%-25% shares get diluted at this stage and founders need to be careful in dilution as they may have to raise funds in future as well and may have to dilute more equities. [AdSense-B]

Valuation at this stage is mainly determined based on various factors including how much funds you need to run the business for a given time period Investors generally want to see growth in 18 months. Example: If your business needs around Rs 1 crore and your company raises Rs 1 crore in exchange of 20% shares, value of your company is Rs 5 crores (Rs 1cr / 20%).

To value a startup, following factors are considered:

Revenues: Obviously, revenues are most vital part of the company. Every organisation exists for making money. But, this holds true mainly for B2B companies. Maybe to your surprise, for B2C business, more revenues may lower the valuation of your company. It is because if you are charging your consumer, consumer may not like to deal with you and this adversely impacts your growth and hence valuation

Number of users: If your company has large number of users, it is a concrete proof that company can generate revenues anytime as business model is likable for users. This is called ‘traction’. Snapchat had valuation of $16 Billion without having any revenues. Interesting much? ????

Founder’s goodwill: Be afraid not of sheep leading a pack of lions, but a lion leading a pack of sheep. This is the case here. Investors having confidence in founder and leader of the organisation who has had prior success can easily get funding even if he does not have revenue or traction. Instagram and Pintrest are the best examples of such funding.

Industry of operation: If the industry where your startup belongs to is attractive, investors are more willing to invest at a premium.

Growth Stage [AdSense-B]

This is the stage where your company has revenue or traction. Valuation at this stage is easier and multiples are used here to calculate the value of your company.

Multiples can be calculated from comparable transactions occurred in the market or companies of similar kind for calculating multiple of Enterprise Value to EBITDA or revenue or number of users of that similar company. Once the multiple is known, same can be applied to

Multiple= Enterprise Value

Revenue/EBITDA/no of users

EBITDA/revenue/number of users of the relevant company taking into account different scenarios. Different scenarios here mean highest possible revenue/ebitda/users or lowest possible revenue/ebitda/users.

Other way can be to discount the current and projected future earnings of the company based on the trends of the revenue and other factors. Such aggregated discounted earnings can be used as a value of the startup.

Here also, several other factors are taken into account by investors like management, state of business, opportunities, competition, technology, reputation, external risks, etc. These factors play strong role in negotiation for valuation between founders and investors. Founders always want more valuation while investors would like more equities in exchange of funds.

Exit Stage

Exit Stage: Investors now want return for the money they invested previously in the startup.

They plan to sell their shares to other company or investor or through an Initial Public Offer.

Valuation here is again done keeping in mind the comparable transactions happened in the market for similar companies using their multiples and applying them for the relevant startup.

Replacement cost method is also used to value the company. It means the value of building the similar company from scratch at current point of time.

Projected revenues for future years (generally 10) are discounted at a suitable discount rate (as per industry and company standards) and cumulative discounted revenue can be used as a valuation of the company.

Good entrepreneurs and investors choose to use mixture of valuation methods to value their company based on the situations and industry and then use them as a tool to negotiate better.

At every stage, lot of comprehensive research and analysis of the company and industry is required since many assumptions and estimates are made at the time of valuation. That is what makes startup valuation a mixture of science and art.

Next time when somebody asks you “Toh kya keemat h tumhare startup ki?” Go proudly tell what it is. ????

Whom To Approach

You can choose from a list of best chartered accountants in delhi at our homepage and get your startup valuation done with ease.