Start A Private Limited Company In Delhi / Bangalore / Mumbai – Anywhere in India

Start A Private Limited Company In Delhi / Bangalore / Mumbai – Anywhere in India

If you want to Start A Private Limited Company in Delhi, Pune, Bangalore, or anywhere in India, then this article will guide everything you need to know to kick off. A Private Limited Company can be incorporated by following the provisions and regulations stated under the Company’s Act 2013. It enjoys greater stability, legal identity, it is flexible and a greater combination of capital. This is supported by the diversified and different abilities of capital accumulation. The private company can be easily identified by just looking at the name, the number of members it incorporates the management, directors, etc. The number of directors who are to incorporate must be mentioned in the Articles of Association. However, the private companies who enjoy its distinguished legal entity and the private companies which are the subsidiary of the other public companies are differentiated in Company’s Act.

Minimum Directors Required to Start Private Limited Company:

The minimum number of persons required for the incorporation is 2. Whereas the maximum limit of the number of persons is 50.

How Much Time Does It Take To Start Pvt. Ltd. Company:

It usually takes 15-20 days to register a Private Limited Company through INC 29 (A single application for Reservation of Name, Incorporation of Company, and Allotment of DIN), subject to ROC processing time. Venture-Care makes Private Limited Company Registration easy for you.

Click here to know about Compliance for a private limited company

Minimum Requirements To Start Pvt. Ltd. Company:

- A minimum of two members is required.

- The minimum capital required to start the private limited is Rs. 100,000

- DIN of two members.

- Digital Signature for all directors

- Consent either from the subscriber or director

- Address proof of the registered address

- NOC which will be provided by the owner of the property or premises

- Minimum of Director must be resident of India

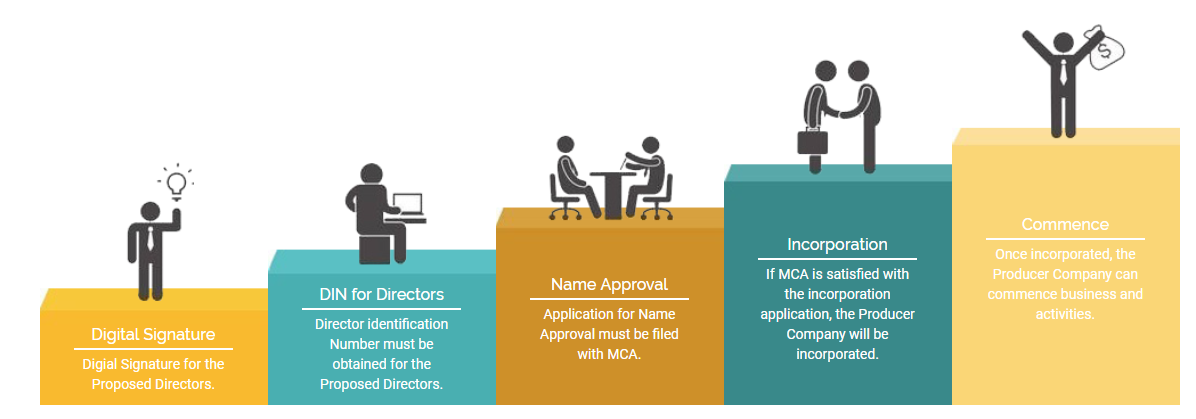

Procedure to Start a Private Limited Company:

Documents Required to Start a Pvt. Ltd. Company:

- Two colored photographs of all the members

- PAN card of all the associates

- Address proof of all

- If the premises is on rent or lease, the respective documents need to be provided

- Signature on DSC form

- Signature on Affidavit for the DIN

- Signature on the consent form

- Signature on subscriber sheet

Advantages of Pvt. Ltd. Company

-

Separate Legal Entity

A company is a legal entity and a juristic person established under the Act. Therefore a company form of organization has wide legal capacity and can own property and also incur debts. The members (Shareholders/Directors) of a company have no liability to the creditors of a company for such debts.

-

Uninterrupted Existence

A company has ‘perpetual succession’, that is continued or uninterrupted existence until it is legally dissolved. A company, being a separate legal person, is unaffected by the death or other departure of any member but continues to be in existence irrespective of the changes in membership.

-

Borrowing Capacity

A company enjoys better avenues for borrowing funds. It can issue debentures, secured as well as unsecured, and can also accept deposits from the public, etc. Even banking and financial institutions prefer to render large financial assistance to a company rather than partnership firms or proprietary concerns

-

Easy Transferability

Shares of a company limited by shares are transferable by a shareholder to any other person. Filing and signing a share transfer form and handing over the buyer of the shares along with a share certificate can easily transfer shares.

-

Owning Property

A company being a juristic person, can acquire, own, enjoy and alienate, property in its own name. No shareholder can make any claim upon the property of the company so long as the company is a going concern.

-

Limited Liability

Limited Liability means the status of being legally responsible only to a limited amount for debts of a company. Unlike proprietorship and partnerships, in a limited liability company, the liability of the members in respect of the company’s debts is limited.

FAQ- Frequently Asked Question

What are the rules for picking a name for a private limited company?

The registrar of companies (RoC) across India expects applicants to follow a few naming guidelines. Some of them are subjective, which means that approval can depend on the opinion of the officer handling your application. However, the more closely you follow the rules listed below, the better your chances of approval. First, however, do ensure that your name is available.

How much time is needed for setting up a private limited company in India?

If you have all the documents in order, it will take no longer than 15 days. However, this is dependent on the workload of the registrar.

Do I need to be physically present during this process?

No, new company registration is a fully online process. As all documents are filed electronically, you would not need to be physically present at all. You would need to send us scanned copies of all the required documents & forms.

What documents are required to complete the process?

All directors must provide identity and address proof, as well as a copy of the PAN card (for Indian nationals) and passport (for foreign nationals). No-objection certificate must be submitted by the owner of the registered office premises.

Is it necessary to have a company’s books audited?

Yes, a private limited company must hire an auditor, no matter what its revenues. In fact, an auditor must be appointed within 30 days of incorporation. Compliance is important with a private limited company, given that penalties for non-compliance can run into lakhs of rupees and even lead to the blacklisting of directors.

What is the minimum capital needed to form a private limited company?

There is no minimum capital required for starting a private limited company.

Can the limited liability partnership (LLP) be converted to a private limited company?

No, one cannot convert an LLP into a private limited company as it is not an MCA. The LLP Act, 2008, and the Companies Act, 2013, both don’t have any provisions on the conversion of the LLP is a private limited company. However, if one wants to expand their business they can register a new private limited company with the same name. The LLP company needs to just issue a no-objection certificate.

Can one register a private limited company on their home address?

Yes, the company can be registered at the owner’s home address. A copy of the utility bill is required to be submitted.

Does one have to be present in person for the incorporation of a private limited company?

The entire procedure is done online and one does not have to be present at our office or any other place for the incorporation. A scanned copy of the documents has to be sent via mail. They get the company incorporation certificate from the MCA via courier at the business address.

Can NRIs/foreign nationals become directors in a private limited company?

Yes, an NRI or a foreign national can become a director of a private limited company. He or she must obtain a DIN from the Indian RoC. They can also hold a controlling stake in the company. As long as at least one director on the board of directors is an Indian resident.

Who can help me to Start Pvt. Ltd. Company

You can choose from a list of CA in Delhi from our homepage. They can help you start a Pvt. Ltd. company in Delhi, Pune, Bangalore, or anywhere in India without any hassle. All you need to do is make a phone call, sit back and relax.