Company Incorporation Zero Fees Update : Pocket Friendly

Company Incorporation Zero Fees Update: Now Much Easier and Pocket Friendly

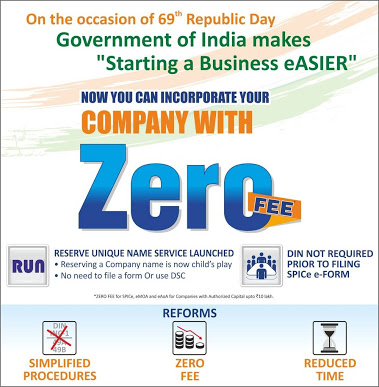

On the occasion of 69th Republic Day, the Ministry of Corporate Affair has made starting a business much easier for Private Limited Companies, and LLPs. MCA has announced company incorporation zero fees update, this post will guide you all.

- Reserve Unique Name (RUN) Form

(Revised Name Approval Process)

An application for reservation of a name shall be made through the web service available at www.mca.gov.in by using RUN (Reserve Unique Name) along with a fee of Rs 1,000 which may either be approved or rejected, as the case may be, by the Registrar, Central Registration Centre”.

- RUN a new platform for reservation of name of the Company. All you need to know about is:

A small Webform with 4 information

– Entity Type

– CIN, only in case of name change

– Proposed name (Auto check facility available)

– Comments (Proposed objects and any other comments)

- An approved name is valid for a period of

(i)20 days from the date of approval (new company) or

(ii)60 days from the date of approval (existing company). - Director Identification Number (DIN) Application – Revised Rule

As per the revised amendment now if you want to apply for DIN then you can apply via the SPICE Incorporation Form, DIN will be an issue only at the time of Incorporation only.

- As per the new rule DIN will be issued to the company to which the Director would be added and DIN Declaration to be mentioned the CIN Number.

- In the short allotment of DIN by allotting it through combined SPICe Form only at the time of an individual’s appointment as Director(in case he/she doesn’t have a DIN).

Company incorporation zero fees:

Ministry of Corporate Affairs announced Zero Fee for incorporation of all companies with an authorized capital up to Rs.10 lakh.

Provided further that in case of companies incorporated, with effect from the 26th day of January 2018, with a nominal capital of less than or equal to rupees ten lacs or in respect of companies not having a share capital whose number of members as stated in the articles of association does not exceed twenty, fee on INC-32 (SPICe) shall not be applicable.

Form No.INC-7 shall be omitted;

Provided further that in case of incorporation of a company having more than seven subscribers or where any of the subscribers to the MOA/AOA is signing at a place outside India, MOA/AOA shall be filed with INC-32 (SPICe) in the respective formats as specified in Table A to J in Schedule I without filing form INC-33 and INC-34

How To Start A Company:

Click here to know how to start a private limited company or directly contact any chartered accountant in Delhi available on CA in Delhi‘s homepage.